Request To Waive Penalty : Sample Letter Waiver Of Penalty For Reasonable Cause Fill Online Printable Fillable Blank Pdffiller - Essentially, if you miss a payment, don't file a tax return, or make a deposit, then you have a chance to avoid the penalty.

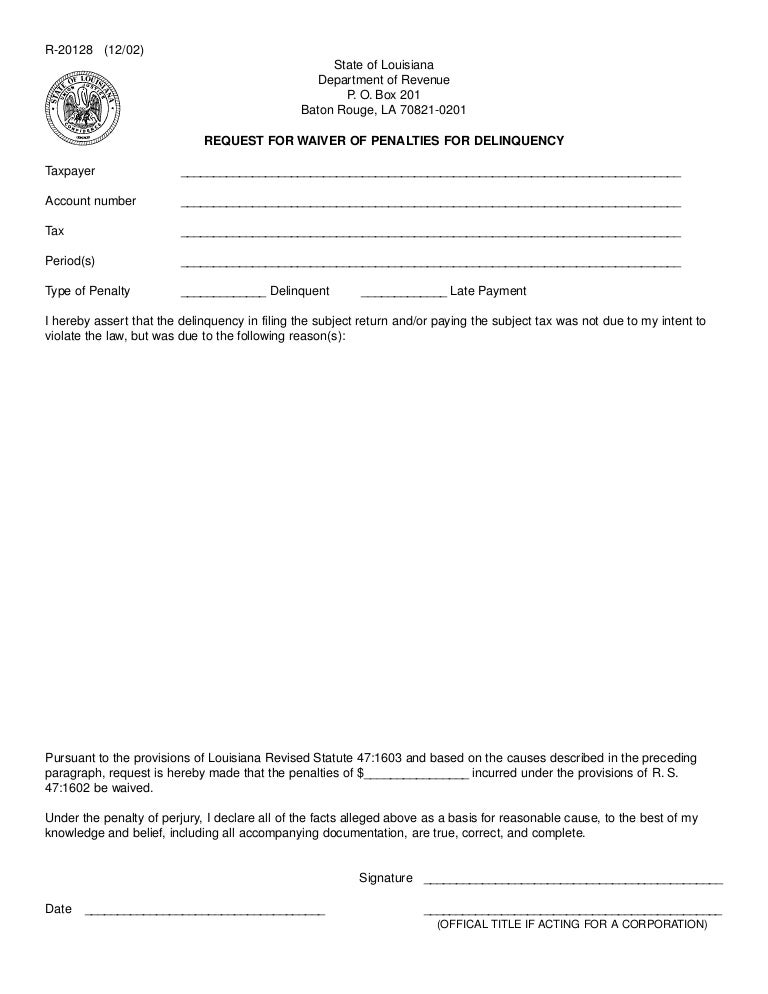

Request To Waive Penalty : Sample Letter Waiver Of Penalty For Reasonable Cause Fill Online Printable Fillable Blank Pdffiller - Essentially, if you miss a payment, don't file a tax return, or make a deposit, then you have a chance to avoid the penalty.. To request a waiver, you should do the following you'll need to complete form 843, claim for refund and request for abatement, put 80% waiver of estimated tax penalty on line 7 of the form and mail the. Request for waiver of penalty penalties shall be waived upon a determination of reasonable cause. The irs will not offer them to you, even if you qualify. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. The only way to get tax penalties waived is to request relief.

For the failure to file or pay penalty, taxpayers can request that the irs abate the penalties. The fact that i went in to the red at all is a testament to my financial hardship. You can use this template as a guide to help you write a letter. 1) you didn't make a required payment because of a casualty event, disaster, or other unusual circumstance and it would be inequitable to impose the penalty, or Dear sir or madam, regarding checking account:

You may qualify for relief from penalties if you made an effort to comply with the requirements of the law, but were unable to meet your tax obligations, due to circumstances beyond your control.

If you received a notice, be sure to check that the information in your notice is correct. I wrote this letter to request to waive my penalty for the late rental fee. A bank fee may be accumulated in the account of a customer for receiving a service that is not a routine bank function. A request letter to waive bank fees is written by the customer of a bank to bank authorities requesting them to waive the bank fees for various reasons, as may be illustrated. To request a waiver, you should do the following you'll need to complete form 843, claim for refund and request for abatement, put 80% waiver of estimated tax penalty on line 7 of the form and mail the. For taxpayers willing to write a penalty abatement letter to the irs, you should know that there are a few necessary things that need to be included in the letter to be sent. For instance, you may be given a citation, a penalty fee, or a new financial obligation. You also are getting a waiver on the penalty itself rather than the taxes you owe. Penalty relief due to first time penalty abatement or other administrative waiver the irs may provide administrative relief from a penalty that would otherwise be applicable under its first time penalty abatement policy. I would like to request that you consider reimbursing bank charges you applied to an unplanned overdraft that has been building up since last year. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law, but were unable to meet your tax obligations, due to circumstances beyond your control. If you have reasonable cause, we may waive penalties. Now that you've gotten your tax documents together, you can call the irs to ask for a tax penalty waiver.

To request a waiver, please select request a tax penalty waiver from the dropdown list in the message box on our online form. Interest associated with penalties can also be removed if a penalty is waived. Penalty relief due to first time penalty abatement or other administrative waiver the irs may provide administrative relief from a penalty that would otherwise be applicable under its first time penalty abatement policy. For the failure to file or pay penalty, taxpayers can request that the irs abate the penalties. These would be situations likely out of the taxpayer's ability to control, such as fire, natural disaster, or other forces that prevent the taxpayer from filing or paying taxes.

The only way to get tax penalties waived is to request relief.

For taxpayers willing to write a penalty abatement letter to the irs, you should know that there are a few necessary things that need to be included in the letter to be sent. Request for waiver of penalty penalties shall be waived upon a determination of reasonable cause. Waiver requests for late reports and payments the comptroller's taxpayer bill of rights includes the right to request a waiver of penalties. The fact that i went in to the red at all is a testament to my financial hardship. A bank fee may be accumulated in the account of a customer for receiving a service that is not a routine bank function. If you file electronically, there is a box to check to request a penalty waiver. Writing a waiver penalty letter sample hardship letter a waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you for instance you may be given a citation a penalty fee or a new financial obligation if you feel that such is undeserved or if you feel that it would unfairly affect you then you can ask for it to be waived how to write a penalty. Sample irs penalty abatement request letter. This is due to the reason that i was not able to pay on time because our company had a financial problem. For the failure to file or pay penalty, taxpayers can request that the irs abate the penalties. If you have reasonable cause, we may waive penalties. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law, but were unable to meet your tax obligations, due to circumstances beyond your control. You can't apply for a waiver until after the tax deadline has passed, and you must apply once for each bill.

You also are getting a waiver on the penalty itself rather than the taxes you owe. If you have any questions, call us at the telephone number written. You can't apply for a waiver until after the tax deadline has passed, and you must apply once for each bill. If you have reasonable cause, we may waive penalties. Here is a sample letter to request irs penalty abatement.

I wrote this letter to request to waive my penalty for the late rental fee.

We will review your request and respond in writing. Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. Here is a sample letter to request irs penalty abatement. Abatement is simply removing the penalties after they are assessed to the taxpayer. Writing a waiver penalty letter sample hardship letter a waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you for instance you may be given a citation a penalty fee or a new financial obligation if you feel that such is undeserved or if you feel that it would unfairly affect you then you can ask for it to be waived how to write a penalty. You can use our online form to request a waiver of penalties and/or interest that was assessed because you filed or paid a tax report late. Request for waiver of penalty penalties shall be waived upon a determination of reasonable cause. Click the button below to file. Below is the phone call script i use to negotiate musicians' tax penalties. If you have any questions, call us at the telephone number written. To request a waiver, please select request a tax penalty waiver from the dropdown list in the message box on our online form. The taxpayer has the burden of proving that the penalty waiver request is valid. A waiver letter is a formal written request for the party receiving the letter to forego a certain restriction that would otherwise be put into effect, such as a financial obligation, contract, or a citation.however, writing a letter of waiver isn't a 100 percent guarantee that the other party will comply.

Komentar

Posting Komentar